In recent years, the funding landscape has seen a major shift, with many traders diversifying their portfolios to incorporate treasured top-rated precious metals iras, significantly gold. Among the assorted funding reliable options for precious metals iras out there, Gold Individual Retirement Accounts (IRAs) have gained recognition as a technique of safeguarding retirement financial savings against market volatility and inflation. This text explores the current developments, advantages, and challenges related to Gold IRA investing, drawing on observational analysis and anecdotal evidence from buyers and monetary advisors.

Understanding Gold IRAs

A Gold IRA is a self-directed particular person retirement account that permits investors to hold bodily gold and other valuable metals as part of their retirement portfolio. Unlike conventional IRAs, which typically consist of stocks, bonds, and mutual funds, Gold IRAs provide a tangible asset that can function a hedge against economic downturns. Investors can include numerous types of gold, similar to bullion coins, bars, and even sure kinds of jewelry, supplied they meet the IRS necessities for purity and authenticity.

Observational Tendencies in Gold IRA Investing

Elevated Popularity

Over the previous decade, there was a noticeable enhance within the number of traders turning to Gold IRAs. This trend might be attributed to several elements, including economic uncertainty, rising inflation charges, and geopolitical tensions. Observations from financial advisors point out that many purchasers are seeking to diversify their retirement portfolios to incorporate property that are less correlated with traditional markets. Consequently, the demand for Gold IRAs has surged, leading ira companies for precious metals to the institution of numerous custodial services and investment firms specializing in treasured metals.

Demographic Shifts

The demographic profile of Gold IRA investors has also advanced. Initially, Gold IRAs attracted older investors who were nearing retirement and on the lookout for secure havens for their savings. Nevertheless, current observations suggest that younger investors, significantly millennials and Generation X, are increasingly considering gold as an extended-term investment strategy. This shift may be driven by a rising consciousness of economic instability and a need for tangible belongings that may retain worth over time.

On-line Platforms and Accessibility

The rise of on-line funding platforms has made Gold IRA investing extra accessible to the typical investor. Many corporations now offer person-pleasant websites and cellular purposes that permit people to simply arrange and handle their Gold IRAs. Observations present that this elevated accessibility has led to a broader demographic engaging with gold investments, as younger traders are extra snug navigating digital platforms. If you adored this article and you would like to obtain additional information pertaining to recommended firms for gold ira rollover (www.realestate.co.na) kindly browse through our own website. The comfort of on-line transactions has also contributed to the rising recognition of Gold IRAs.

Advantages of Gold IRA Investing

Hedge Towards Inflation

One among the primary reasons buyers choose Gold IRAs is the asset's historic capability to act as a hedge against inflation. As the value of fiat currencies declines, gold has persistently maintained its buying power. Observational information from monetary markets during intervals of inflation show that gold prices tend to rise, making it an attractive possibility for these looking to preserve their wealth.

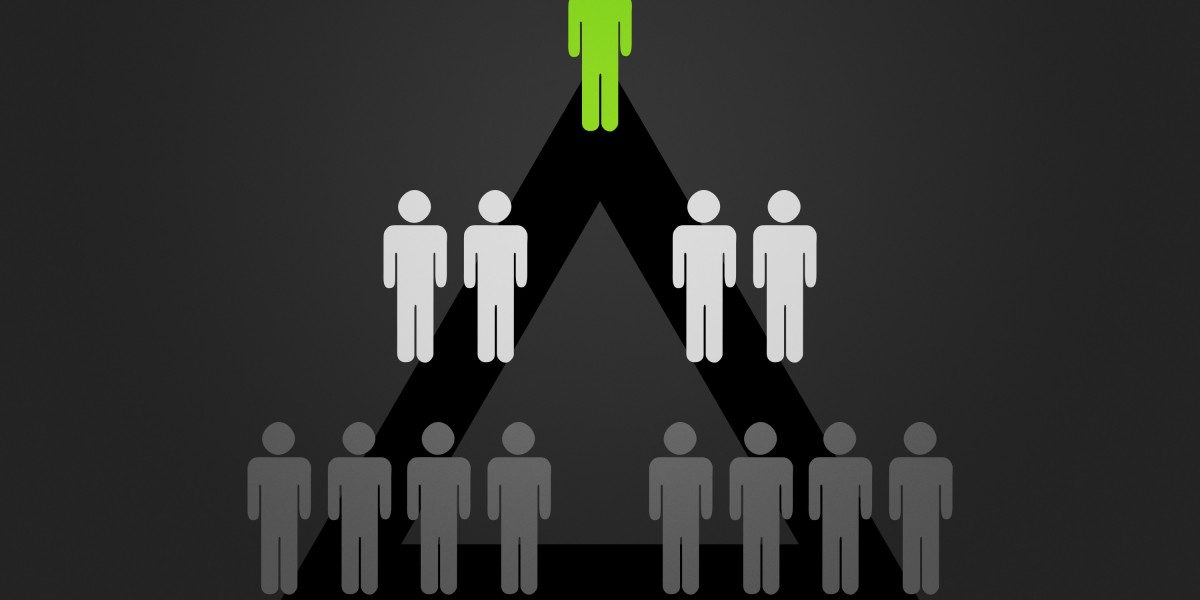

Portfolio Diversification

Gold IRAs present a singular opportunity for diversification within retirement portfolios. Financial advisors typically recommend a mixture of asset lessons to mitigate danger, and gold can function a stabilizing force during market volatility. Observations point out that buyers who embody gold in their portfolios often expertise less drastic fluctuations in worth compared to those that rely solely on stocks and bonds.

Tangible Asset Ownership

Investing in a Gold top ira companies for gold investments permits individuals to own physical gold, which might provide a way of security and management over their investments. In uncertain economic occasions, many buyers want tangible assets that they'll hold and store. Observational research means that the psychological consolation of owning bodily gold can result in elevated investor confidence, significantly during market downturns.

Challenges of Gold IRA Investing

Regulatory Compliance

While Gold IRAs supply quite a few benefits, they also come with regulatory challenges. Traders must adhere to strict IRS tips regarding the types of gold and other treasured metals that can be included in their accounts. Observations from monetary advisors spotlight the significance of working with reputable custodians who are properly-versed in these laws to avoid potential pitfalls.

Storage and Insurance Costs

Another challenge related to Gold IRAs is the price of storage and insurance coverage for bodily gold. Not like conventional investments, which can be held electronically, gold have to be saved in secure facilities, often incurring additional fees. Observational data counsel that these costs can eat into the overall returns of Gold IRA investments, making it essential for investors to carefully consider the financial implications.

Market Volatility

Whereas gold is commonly seen as a secure haven, it's not immune to market volatility. Observations from latest market developments point out that gold prices can fluctuate considerably primarily based on global financial conditions, interest charges, and investor sentiment. As such, buyers have to be ready for the potential for short-term price swings, which may impact the value of their Gold IRAs.

Conclusion

Gold IRA investing has emerged as a compelling option for these looking for to diversify their retirement portfolios and protect their savings towards financial uncertainty. Observational research highlights the rising popularity of Gold IRAs among a diverse vary of buyers, pushed by the need for tangible assets and a hedge towards inflation. While there are challenges related to regulatory compliance, storage costs, and market volatility, the advantages of Gold IRAs proceed to draw consideration within the funding community. Because the panorama of retirement investing evolves, gold remains a timeless asset that offers distinctive advantages and opportunities for investors looking to secure their financial futures.